Your Cart is Currently Empty: ৳ 0.00

Greatest $5 Minimal Deposit Casinos to own January 2026

Articles

You need your own partner’s demise certification, your own marriage certificate, and your banking info4. My spouse gets her very own SS but i will be wondering if she will be switch to survivors when i solution (im 12 yrs more mature). I understand the newest frustration, in my experience coping with widowed members, survivor work with software are actually prioritized because of the SSA. 90 days instead advantages might possibly be disastrous. They really mess up direct deposit facts A whole lot!!

Justin can also be’t explore you to definitely $dos,150 to minimize the amount he’s required to withdraw to possess 2026. Justin’s IRA account balance on the December 30, 2024, is $38,400. It doesn’t mean you do not decrease your IRA account balance. A similar rule can be applied while you are a designated beneficiary out of one or more IRA which had been owned by one decedent. Although not, you could potentially complete this type of lowest amounts or take the complete from anyone or even more of your IRAs. New way life expectancy tables apply to distribution diary ages delivery on the otherwise immediately after January 1, 2022.

NFL Survivor Day 17 Selections and you may Event Means (

A surviving spouse is roll-over the newest shipping to a different traditional IRA and steer clear of as well as they in the earnings for the seasons acquired. Although not, the fresh recipient can not bring any deduction to own home income tax. You must begin getting withdrawals regarding the IRA under the laws to own distributions you to affect beneficiaries. A beneficiary is going to be anyone otherwise organization the dog owner decides for the key benefits of the newest IRA following the proprietor dies. Listed below are a few benefits associated with a traditional IRA.

Easiest selections

For individuals who borrow money facing the IRA annuity offer, you need to include in the gross income the fresh reasonable market value of the annuity deal by the initial day’s the tax year. Should your membership ends are an enthusiastic IRA since you or their recipient engaged in a banned transaction, the new membership try treated since the distributing the its possessions for your requirements during the the fair business values for the first day of the seasons. Basically, for many who otherwise the beneficiary engages in a prohibited deal inside the connection with your own IRA account any moment inside the season, the new membership finishes becoming an IRA since the original time of this year. Declaration fully nonexempt withdrawals, and early distributions, to the Setting 1040, 1040-SR, or 1040-NR, line 4b (no admission is required on line 4a). Federal taxation are withheld of withdrawals out of conventional IRAs unless of course you select not to have tax withheld. Whenever calculating the new nontaxable and taxable levels of withdrawals produced past so you can demise in the year the new IRA membership proprietor dies, the value of the antique (in addition to Sep and easy) IRAs is going to be thought by the new date of death alternatively of December 30.

How we Discover Survivor Sportsbooks On the web

- If your owner passed away once 2019 and the beneficiary is actually an enthusiastic individual that are a designated recipient, see the 10-12 months rule, for more information.

- The new New orleans saints have forfeit around three in a row since their victory along the Gambling for the October. 5.

- Unless the brand new beneficiary requests if you don’t, income tax will be withheld in line with the price of a good hitched person with about three exemptions.

- Have fun with Table I for a long time following the seasons of your own proprietor’s death while you are the master’s qualified designated beneficiary.

- The brand new Falcons, Carries, Packers, and you can Steelers are common bringing this week out of, and this will getting a bit just before we have from byes.

The new 49ers crime will be able to winnings this video game by themselves in the event the its burns off-riddled protection feel any problems. They can’t stop the brand new work on and you may groups is shredding the secondary tool from heavens. Defensively, the fresh Cardinals ranked 31st within the EPA/gamble and 32nd inside the rate of success this past week-end contrary to the Commanders. The only game in which Washington’s crime has scored over 20 points so it fall came up against a la Rams team that was totally decimated by injuries. The new San francisco bay area 49ers are a flawed party, and they have already been serpent-bitten by wounds to start 2024, however their Few days 5 enemy provides very few redeemable functions.

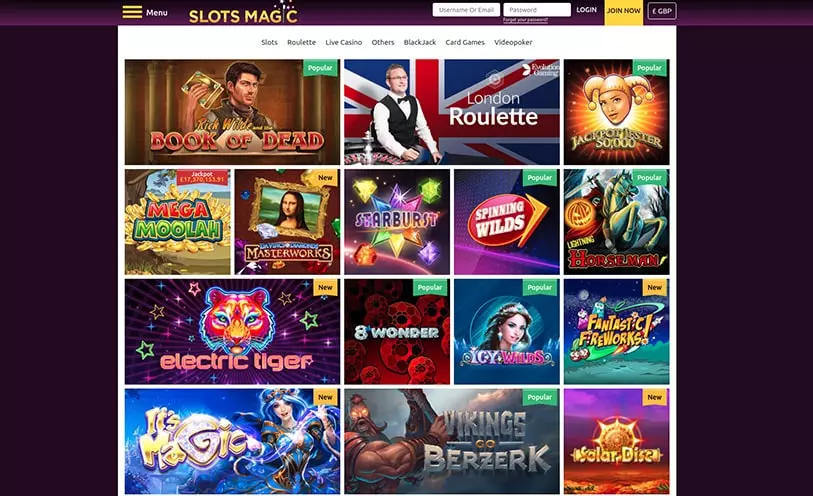

Fortunately you to a $5 deposit is over sufficient. As the identity means, what you need to create is actually manage a person membership. They’re are not found in a pleasant give and certainly will end up being combined along with other promos, for example put tick this link here now match bonuses. They supply safer local casino platforms, plenty of game, and simple a way to put and you will withdraw, making them the best selection if you wish to start to try out with only $5. As stated ahead of, there are about three Us online casinos you to undertake $5 dumps and all of about three are extremely common. The good thing of the offer is the 1x playthrough demands, meaning you only need to wager the advantage money once ahead of the money try your to save.

Love the newest assortment inside 12 months enough time and you may weekly online game. For many who victory, your move on to the next few days. Check out the agenda to see their winner for the week. Wagering operators haven’t any dictate more nor is any such income by any means determined by otherwise linked to the newsrooms otherwise news publicity.

It doesn’t reduce your survivor benefits, nevertheless they want to know for their facts. First, don’t worry on the establishing head put ahead of time – the newest SSA representative often certainly handle you to via your mobile phone meeting. I experience the brand new survivor advantages process regarding the 18 months back and you will desired to express a few extra information you to definitely helped me. They are going to prize you any type of work for are highest (even when to suit your needs, it sounds for instance the survivor work for will be the only choice).Allow them to manage the brand new direct deposit settings inside the name – one shorter issue for you to worry about today.

If your only recipient of your IRA will be your mate and you may your spouse is more than 10 years younger than just your, utilize the relevant denominator of Table II inside Appendix B. Just recipient spouse who is more than ten years young. You’re partnered plus mate, who is really the only recipient of one’s IRA, are 6 decades young than simply you. Your account balance after 2025 is $a hundred,000.

Should your holder passed away prior to the necessary birth time plus the enduring partner is the best designated recipient, you to definitely companion can also be decide to become handled since the IRA holder. On the different, come across Loss of enduring mate ahead of time distributions start, later on. Essentially, the newest appointed recipient is set to the Sep 31 of one’s calendar 12 months following the twelve months of the IRA owner’s death. (Required Lowest Distributions), you may have to spend an excise income tax regarding 12 months for the number perhaps not distributed as needed. Since December 30, 2025, their leftover account balance is $one hundred,100000, plus the value of the fresh annuity bargain is actually $200,100. Inside the 2025, you order an annuity deal having a portion of your bank account harmony.

Read the FantasyLabs’ season-much time survivor analysis to help you make your NFL Survivor picks for Month 5. Pond Wizard will provide you with for every NFL group’s chance fee to help you win each week. Hardly does the newest survivor pond athlete whom picks thoughtlessly turn out at the top. Hand-selecting weeks where mediocre groups play the poor organizations in the category also offers an advantage.

Underneath the Schwab Shelter Ensure, Schwab covers loss in any of your Schwab profile due to not authorized interest. Buy brings, ETFs, possibilities, bonds, and more with a personal account. Purchase on your own, exchange that have thinkorswim, and now have full-services wealth management everything in one lay. The eye accrues a-year to your a good deposit which can be compounded annually, through to the deposit is paid. (ii) The level of contributions lower than so it area means the level of Government benefits which may were necessary for the service lower than section 8423 of label 5, All of us Password, if your provider was secure below part 84 away from label 5, Us Code, as well as desire. (7) Running put software and costs.

It distribution should be generated in person from the trustee of one’s IRA to the trustee of the HSA. The new distribution have to be below or comparable to their limitation yearly HSA contribution. You cannot get this shipping of a continuous Sep IRA or Simple IRA. You might be capable of making a qualified HSA money shipping from the antique IRA otherwise Roth IRA to the HSA. One-go out qualified Fitness Family savings (HSA) money delivery. Jim decides to generate a qualified charity distribution from $6,five-hundred to own 2026.